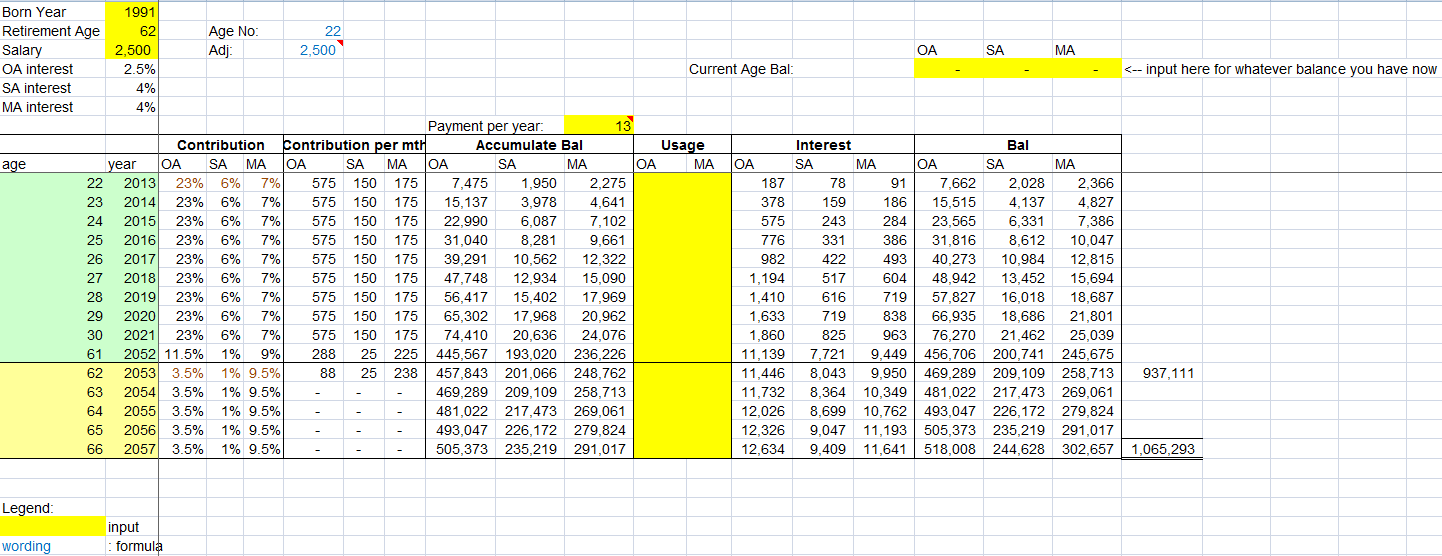

Senario 1: One graduate born in 1991, start work on age 22 with salary S$2,500. If he retire at age 62, he can get at least $1,065,293 at age 66.

Senario 2: One born in 1985, salary $3k, with current CPF: OA:$10k, SA:$11k, MA:$9k. If he retire at age 62, he can get at least $1,081,571 at age 66.

Why I said "at least"? First, the salary will be increase from time to time. Second, this exclude the additional 1% for the $60k total in 3 accounts.

So, don't under estimate the power of compound interest and do appreciate what Singapore government is doing for her people. Number proof everything.

You may use the calculator to check your contribution at:

http://www.cpf.gov.sg/cpf_info/Online/Contri.asp?prof=emp

I have developed an Excel to forecast your CPF when you retired:

https://www.dropbox.com/s/yxadzm96k8lhs7v/CPF_Calculator.xls

Hi could you share the excel to forecast cpf spreadsheet again to daphane_456@hotmail.sg thanks!

ReplyDelete